CarShield Review 2026: What the $10M FTC Settlement Reveals About Traditional Warranties

Last Updated: November 21, 2025 | 12 min read

In July 2024, CarShield review news made headlines when the company agreed to pay $10 million to settle Federal Trade Commission allegations of deceptive advertising. For the extended warranty industry's largest direct-to-consumer provider—a company that covers over 2 million vehicles—this wasn't just a fine. It was a snapshot of everything wrong with how traditional warranties operate in a modern marketplace.

This comprehensive CarShield review examines not just one company's missteps, but the fundamental disconnect between old-school warranty models built for 1990s consumers and today's digital-first buyers who expect transparency, simplicity, and flexibility. We'll explore the FTC settlement details, analyze customer complaint patterns, decode the confusing coverage tier system, and explain why the traditional multi-layer broker model creates the very problems consumers complain about.

Whether you're researching CarShield specifically or trying to understand the difference between warranties and vehicle service contracts generally, this analysis will help you make an informed decision about protecting your vehicle.

The $10M FTC settlement exposed systemic problems in the traditional extended warranty industry.

What Is CarShield? Understanding the Industry Giant

Founded in 2005 and headquartered in St. Peters, Missouri, CarShield has grown into the extended warranty industry's most recognizable brand. With celebrity endorsers including Ice-T, Chris Berman, and Steve Harvey, the company has built a massive marketing presence that reaches millions of vehicle owners through television, radio, and digital advertising.

CarShield's Market Position:

- 2+ million vehicles currently covered across the United States

- $1+ billion in claims paid (according to company marketing, disputed by FTC)

- Coverage up to 300,000 miles available on eligible vehicles

- Month-to-month payment option alongside traditional term contracts

- Multiple coverage tiers from basic powertrain to near-comprehensive plans

Unlike dealership F&I office warranties, CarShield operates as a direct-to-consumer broker. They market and sell vehicle service contracts, but don't actually administer the claims—that's handled by a separate company called American Auto Shield. This multi-layer structure is standard in the traditional warranty industry, but as we'll explore, it creates inherent conflicts between marketing promises and claims reality.

CarShield Coverage Plans Explained: The Tier Confusion Problem

CarShield offers multiple coverage tiers with premium-sounding names like "Diamond," "Platinum," "Gold," and "Silver." Here's where the first major customer confusion begins: these tiers don't differ just in coverage limits—they differ in what parts are actually covered.

Understanding CarShield’s Coverage Hierarchy

| Coverage Tier | Marketing Position | Actual Coverage Type | Key Limitations |

|---|---|---|---|

| Diamond | "Most Comprehensive" | Exclusionary coverage | Still excludes maintenance, wear items, high-tech systems |

| Platinum | "High Mileage Protection" | Stated component | Hundreds of parts NOT covered vs Diamond |

| Gold | "Popular Choice" | Stated component | Excludes AC, electronics, suspension, steering systems |

| Silver | "Affordable Option" | Powertrain Plus | Only engine, transmission, differential internals |

The Critical Difference: Exclusionary vs Stated Component

This is what most customers don't understand when signing up for CarShield:

❌ Stated Component Coverage (Gold, Platinum, Silver)

- Contract lists specific parts covered

- If your part isn't on the list → Not covered

- Thousands of parts exist on modern vehicles

- Easy to think you're covered when you're not

- Example: "Platinum" sounds comprehensive but may exclude turbos, hybrid systems, advanced electronics

✅ Exclusionary Coverage (Diamond Only)

- Contract lists what's NOT covered

- Everything else is covered (except exclusions)

- Much shorter list to track

- Clearer coverage boundaries

- But: Even Diamond has extensive exclusion lists for wear items, maintenance, modifications

The Coverage Gap That Creates Complaints:

A customer purchasing "Platinum" coverage for $169/month may think they have comprehensive protection because the name sounds premium. When their turbocharger fails ($3,200 repair), they discover turbos aren't covered under Platinum—only Diamond. This perception gap generates most of the "they denied my claim!" complaints across the industry.

According to Consumer Reports, this stated component limitation is "the most common reason vehicle owners feel deceived by their extended warranty." For strategies to handle denials, see our guide on fighting extended warranty denials.

The $10 Million FTC Settlement: What Actually Happened

On July 31, 2024, the Federal Trade Commission announced a $10 million settlement with CarShield to resolve allegations of deceptive advertising and marketing practices. This wasn't CarShield's first regulatory issue—Missouri's Attorney General had reached a previous settlement in 2020—but the FTC action brought national attention to problems the agency described as industry-wide.

Specific FTC Allegations Against CarShield

- "Comprehensive Coverage" Misrepresentation: CarShield advertised plans as providing comprehensive or extensive coverage while the actual contracts contained what the FTC called "myriad exclusions" that weren't disclosed during the marketing pitch.

- Repair Shop Choice Limitations: Marketing suggested customers could use "any repair shop" or "the shop of your choice," but many shops refuse to work with CarShield due to used parts requirements and payment delays.

- Celebrity Endorser Deception: Ice-T and other celebrity spokespersons presented themselves as CarShield customers, but the FTC found they were simply paid endorsers who didn't actually use the service.

- Rental Car Misleading Claims: Advertising promised "no-cost" rental car coverage, but the benefit had numerous conditions and limitations not disclosed upfront.

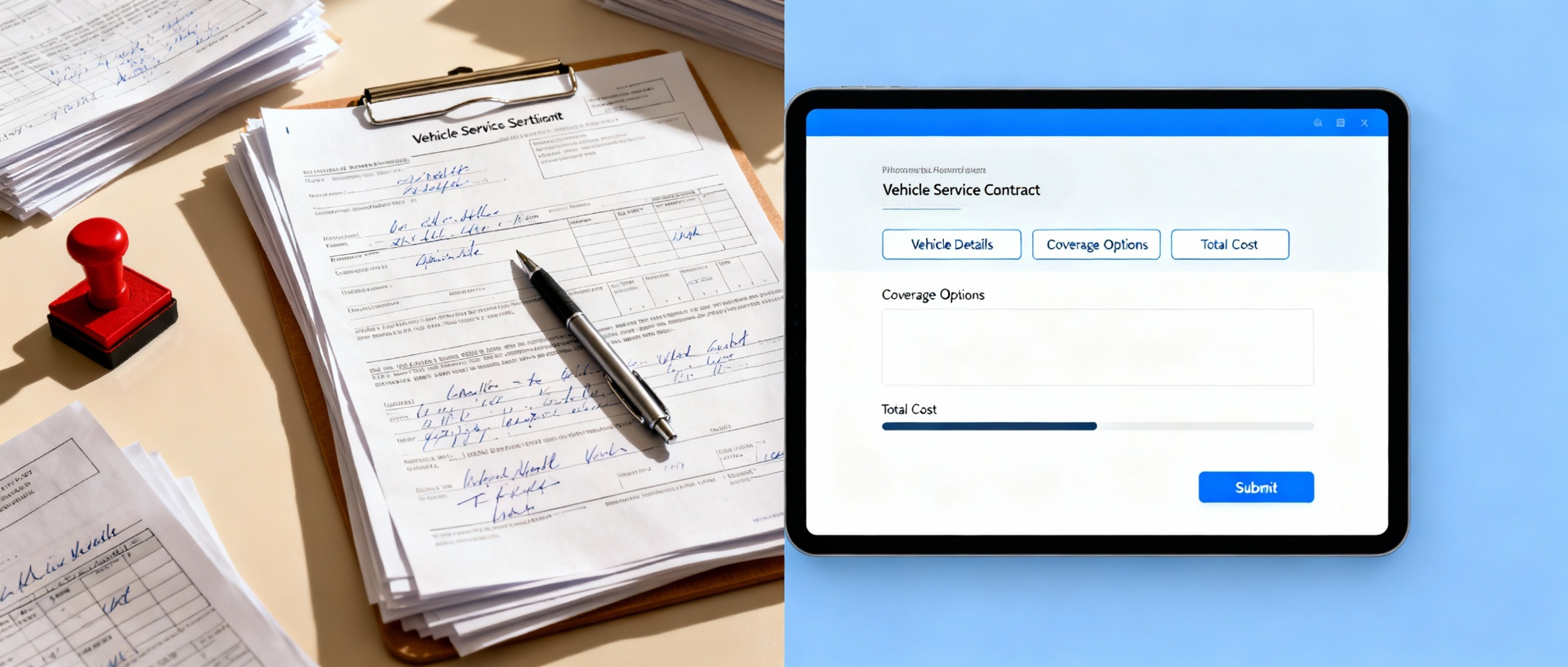

- Dense Contract Disclosure Failures: The actual service contracts ran 25-30 pages with extensive exclusions, but these weren't adequately disclosed to customers during the sales process.

CarShield’s Response and Changes

While not admitting wrongdoing (standard in regulatory settlements), CarShield agreed to:

- Pay $10 million in consumer redress

- Add over 10,000 repair facilities to their approved network

- Revise marketing materials to include clearer limitation disclosures

- Implement stricter advertising review protocols

- Update telemarketer scripts to prevent misrepresentation

The traditional broker model means only 5-10% of your premium may reach actual claims reserves.

The Real Customer Experience: What CarShield Reviews Reveal

Any CarShield review analysis must look at actual customer experiences beyond the company's marketing claims. The data reveals a stark divide between platforms and a clear pattern of specific complaint types.

Why such different ratings? The BBB primarily receives complaints from unhappy customers with unresolved issues, while Trustpilot captures more diverse experiences including satisfied customers. Both data sets are valid but represent different self-selected populations.

Most Common CarShield Complaints by Category

| Complaint Type | Frequency | Core Issue |

|---|---|---|

| Coverage Denials | 35% of complaints | "Part not covered under my tier" or "Pre-existing condition" |

| Repair Shop Issues | 25% of complaints | Shops won't accept CarShield due to used parts requirements |

| Claims Processing Delays | 20% of complaints | Extended approval times leaving vehicles in shop for weeks |

| Cancellation Difficulties | 12% of complaints | Complex cancellation process, refund disputes |

| Pricing Surprises | 8% of complaints | Undisclosed surcharges, deductible confusion, price increases |

Understanding the “Pre-Existing Condition” Pattern

One of the most frustrating complaint patterns involves claim denials for "pre-existing conditions." Understanding how pre-existing condition clauses work is critical before purchasing any warranty. If a mechanic notes any evidence of prior wear or damage to a related system, the warranty company may argue the failure was pre-existing—even if the customer had no knowledge of any problem.

Know Your Vehicle Before Buying Any Coverage

Whether you choose CarShield or any other warranty provider, understanding your vehicle's history is essential. Before purchasing coverage, run a comprehensive vehicle history report to check for:

- Previous accidents: Damage that administrators may classify as "pre-existing"

- Salvage or rebuilt titles: May disqualify vehicle from coverage entirely or trigger surcharges

- Service records: Documentation that helps prevent pre-existing condition denials

- Auction history with photos: Shows actual condition when sold wholesale

- Odometer discrepancies: Could indicate tampering affecting eligibility

Many of the "pre-existing condition" denials in BBB complaints could have been avoided if customers knew their vehicle's complete history before purchasing coverage. This documentation also helps you fight back if a legitimate claim is wrongly denied.

The Traditional Warranty Business Model: Why This Creates Problems

To understand why CarShield and similar companies generate so many complaints, you need to understand the fundamental economics of the traditional warranty broker model. This isn't about one company being unethical—it's about a business structure that creates inherent conflicts between customer expectations and company incentives.

The Multi-Layer Distribution Chain

| Layer | Typical Percentage | Function |

|---|---|---|

| Dealer Markup (if purchased through dealer) | 30-50% | Dealer's profit for selling the contract |

| Broker Commission (CarShield's cut) | 20-25% | Marketing costs, sales commissions, company profit |

| Administrator Fees (American Auto Shield) | 15-20% | Claims processing, network management, overhead |

| Marketing & Overhead | 15-20% | Celebrity endorsements, TV ads, support infrastructure |

| Insurance Backing | 5-10% | Reinsurance costs, regulatory reserves |

| Actual Claims Reserves | 5-10% | Money available to pay your actual claims |

The Fundamental Conflict:

In traditional warranty models, the company's profit interest directly conflicts with the customer's claim interest. Every claim paid reduces profitability. According to NADA, traditional VSC loss ratios (claims paid vs premiums collected) average only 40-55%—meaning companies retain 45-60% of premiums as profit and overhead.

CarShield Pricing & Hidden Costs

CarShield's marketing typically advertises plans "starting at $99/month" or similar low entry prices. But actual costs often differ significantly due to multiple surcharges that aren't disclosed until after you've provided your vehicle information.

| Cost Component | Advertised Message | Actual Reality |

|---|---|---|

| Base Monthly Price | "Starting at $99/month" | $99-$249/month depending on vehicle, mileage, tier |

| Down Payment | Not prominently mentioned | $200-$300 typical first payment |

| Deductible | "Low deductibles" | $100-$500 per repair visit (every time) |

| Branded Title Surcharge | Not disclosed in ads | +$20-40/month if salvage/rebuilt title |

| Turbo/Supercharged Surcharge | Not disclosed in ads | +$10-25/month for forced induction |

| 4x4/AWD Surcharge | Not disclosed in ads | +$10-20/month for 4WD/AWD systems |

| ACTUAL TOTAL | $99/month advertised | $150-$300/month common |

For a complete guide on evaluating coverage options and avoiding hidden costs, see our article on buying extended warranty for used cars.

The warranty industry is evolving from complex broker models toward simpler subscription coverage.

The New Way: Modern Subscription-Based Vehicle Warranties

While CarShield and traditional providers continue operating with multi-tier, multi-layer models built for 1990s consumers, a new category of warranty provider has emerged targeting modern buyers who expect the same transparency and flexibility they get from Netflix, Amazon Prime, and other subscription services.

Old School vs New School: Fundamental Differences

| Feature | Traditional Model (CarShield) | Modern Subscription Model |

|---|---|---|

| Coverage Structure | 5-6 tiers with different parts covered | One coverage type: Exclusionary only |

| Customer Question | "Which tier do I need?" / "Is this part covered?" | "What's my dollar limit?" / "Is this maintenance?" |

| Contract Complexity | 25-30 pages, thousands of parts listed | Short exclusion list (maintenance, wear items) |

| Business Structure | Broker → Administrator → Insurance (3+ layers) | Direct administration (no middlemen) |

| Deductible | $100-$500 per repair visit forever | $300 first 6 months, then $0 for life |

| Price Increases | Variable, often 10-15% annually | Capped (typically 5% max annually) |

| Mileage Limits | Usually won't accept over 150k miles | Often accept up to 250k miles |

As a new-school provider, VIP eliminates tier confusion entirely by offering only exclusionary coverage. Customers simply choose their annual dollar limit knowing that everything except routine maintenance is covered. The deductible drops to $0 after just 6 months. They accept vehicles up to 250,000 miles. And true month-to-month means cancel anytime with no penalties—just stop paying.

Who Should Choose CarShield vs Modern Alternatives?

CarShield (Traditional Model) Might Work Well If You:

- ✅ Want the absolute lowest possible monthly payment and accept higher deductibles and coverage gaps as the tradeoff

- ✅ Are comfortable with complexity and willing to carefully read 25-30 page contracts

- ✅ Have a vehicle under 150,000 miles that fits within their traditional acceptance criteria

- ✅ Have a specific repair shop that accepts CarShield and you've confirmed they're willing to work with them

- ✅ Can afford per-visit deductibles of $100-$500 every time you need a repair

Modern Subscription Model Makes More Sense If You:

- ✅ Value simplicity and transparency over hunting for the cheapest base price

- ✅ Want predictable all-in costs without surprise surcharges

- ✅ Drive higher mileage (150,000-250,000 miles) that traditional providers reject

- ✅ Expect modern consumer flexibility like cancel-anytime terms

- ✅ Are tired of "part not covered" surprises and want exclusionary coverage

- ✅ Want a $0 deductible eventually instead of paying $100-$500 per visit indefinitely

Tired of Complex Coverage Tiers and Hidden Surcharges?

VIP Warranty For Life offers single-plan exclusionary coverage with transparent pricing, $0 deductible after 6 months, and true month-to-month flexibility. See what simple, modern warranty coverage looks like.

Get Your Instant QuoteNo salespeople, no pressure. Just honest pricing in 60 seconds.

The Bottom Line: Is CarShield Worth It in 2026?

After examining the $10 million FTC settlement, analyzing thousands of customer complaints, reviewing the multi-layer business model economics, and comparing traditional vs modern warranty approaches, here's the fair summary:

CarShield Is Not a Scam—But It’s Old School

CarShield is a legitimate company that has paid billions in claims and covered millions of vehicles over 20 years. They're not a scam in the sense of taking money and disappearing. But they operate using a business model designed for 1990s consumers that increasingly fails to meet modern buyer expectations for transparency, simplicity, and flexibility.

The FTC Settlement Reveals Systemic Industry Problems

The $10 million penalty wasn't about CarShield being uniquely bad—it was about the FTC using the industry's largest direct marketer to send a message about widespread practices. The traditional multi-tier, multi-layer broker model creates inherent complexity that confuses customers, economic pressure to narrow coverage interpretations, and misalignment between marketing promises and contract reality.

Frequently Asked Questions: CarShield Review

Is CarShield a Scam or Legitimate Company?

CarShield is a legitimate company founded in 2005 that has covered over 2 million vehicles and paid billions in claims. However, the $10M FTC settlement and BBB F rating indicate significant customer service issues. The company is not a scam, but operates using a traditional multi-tier warranty model that creates confusion and generates complaints.

Why Did CarShield Pay $10 Million to the FTC?

In July 2024, CarShield settled FTC allegations of deceptive advertising including: misrepresenting coverage as "comprehensive" when contracts contained extensive exclusions, falsely claiming customers could use "any repair shop," using celebrity endorsers who weren't actual customers, and failing to adequately disclose contract limitations.

What's the Difference Between CarShield and Modern Subscription Warranties Like VIP?

CarShield uses the traditional model with 5-6 coverage tiers, multi-layer broker structure, stated component coverage on most tiers, and per-visit deductibles forever. Modern subscription providers like VIP offer single exclusionary coverage (one type, just pick your dollar limit), direct administration (no middlemen), $0 deductible after 6 months, and true month-to-month cancellation.

Will CarShield Actually Pay My Claims?

CarShield does pay billions in legitimate claims annually. However, claim denials are common when the repair involves parts not covered under your specific tier, the administrator determines pre-existing condition, the repair shop won't accept used parts or CarShield's payment terms, or the claim falls outside contract terms.

How Do I Avoid Extended Warranty Scams?

Legitimate warning signs include: pressure to "buy today or lose this price," refusal to send contract for review before purchase, inability to verify insurance backing, no physical company address, and unwillingness to answer direct questions. Always verify companies through BBB, state insurance departments, and by calling repair shops in your area to confirm they accept that warranty.

Ready for Simple, Transparent Vehicle Protection?

Skip the coverage tier confusion. VIP Warranty For Life offers one exclusionary plan, transparent all-in pricing, and modern subscription flexibility. See your personalized quote in 60 seconds.

Get Instant Quote NowCovers vehicles up to 250,000 miles • $0 deductible after 6 months • Cancel anytime

Authoritative Sources & References

This CarShield review cites the following authoritative sources:

- Federal Trade Commission (FTC): CarShield $10M Settlement Press Release (July 2024)

- Better Business Bureau: CarShield BBB Profile & Complaint Database

- Consumer Reports: Extended Car Warranty Buying Guide

- National Automobile Dealers Association (NADA): VSC Industry Data & Statistics

Last Updated: November 21, 2025